Illicit financial flows weaken Malawi’s development

The country has weak laws to deal with IFFs, according to experts, who have warned the government not to shield state-embedded actors or others who have been facilitating money laundering activities.

The country has weak laws to deal with IFFs, according to experts, who have warned the government not to shield state-embedded actors or others who have been facilitating money laundering activities such as mis-invoicing and illegal foreign currency externalization through organized crime.

LILONGWE - An estimated 2.1 million Malawian children learn under trees. The learners are exposed to harsh weather and classes are suspended when it rains or when the winds are too strong.

The education sector does not get adequate funding for its operations.

The Civil Society Education Coalition (CSEC) recently indicated that the country is short of K5.1 trillion of the K9.1 trillion needed to finance the sector for the next 10 years.

Ironically Malawi is expected to lose more than that education sector shortfall (K5.1 trillion) through illicit financial flows (IFFs) within the same period.

“I learnt under trees as well during my primary school days in the early 90s,” recalled Divason Chimwaza, a parent to three children who attend Ntchentche Primary School.

“It was a terrible experience. There were days when it was so painful to hold a pen because my hands were so cold. I was frequently suffering from flu and pneumonia.”

Chimwaza was infuriated that nothing had changed and his children were experiencing the same conditions he went through.

“Those stealing government’s money which could have helped in developing this country should be dealt with. They are destroying the future of poor children,” he said.

The country has weak laws to deal with IFFs, according to experts, who have warned the government not to shield state-embedded actors or others who have been facilitating money laundering activities such as mis-invoicing and illegal foreign currency externalization through organized crime.

According to the 2021 Global Financial Integrity report Malawi loses an estimated K520 billion (US$650 million) per year in IFFs. And the 2021 Enhancing Africa’s Transnational Organised Crime (Enact) report indicates that informal and illicit flows increased in the year 2021 as a way of making up for declining revenues from a formal economy due to Covid 19 restrictions.

The Reserve Bank of Malawi (RBM) has reported that since 2019, it has been pursuing a number of cases on illegal externalization of funds, including:

· eight cases of illegal externalization of foreign currency worth about US$1.9 million, which were successfully investigated and prosecuted by July 2019. All the eight accused persons were convicted and sentenced to jail;

· a case of illegal externalization of foreign currency worth US$6 million (through bogus business travel allowances), the investigation of which was completed in 2020. The case is currently under prosecution.

· investigation of 21 other cases of illegal externalization of funds involving bogus foreign travel allowances (worth US$5.2 million) initiated in 2020. The investigation is at an advanced stage and was due to be completed by end-December 2021; and

· current investigation of 12 cases of illegal externalization of funds disguised as importation payments (worth US$7.2 million). The cases involve Chinese nationals who allegedly connived with some employees of a commercial bank to externalize the funds in 2017 and 2018.

Tax havens

An investigation by Malawi’s Platform for Investigative Journalism (PIJ) and the International Consortium for Investigative Journalism (ICIJ), using a trove of leaked documents known as the Pandora Papers, discovered several high-profile corruption suspects, on trial or previously charged with defrauding the state, who are alleged to have stashed millions of possibly ill-gotten wealth in off shore accounts.

The Africa Organised Crime Index 2021 report has rated Malawi among countries that have a very low ability to withstand and disrupt illicit activities due to lack of resources and high corruption levels, among others.

Director of Public Prosecution (DPP) Dr. Steve Kayuni admitted in an interview that his office was facing challenges in completing investigations because of complexities of the organised crime, but said additional prosecution approaches had been introduced where money laundering was being added to any externalization charge.

Gold

Speaking to parliament on 12th of May 2021 President Dr. Lazarus Chakwera said that Malawi exports gold worth an estimated US$85 million annually to the Middle East, and yet nothing comes back as export revenues.

Government’s response, President Chakwera said, was to instruct the RBM to initiate tighter marketing controls for gold.

“In order to curb this malpractice of illegal exports, the Reserve Bank of Malawi has been mandated to facilitate a structured gold market to ensure that export earnings are accounted for and to provide support to small-holder mining operators with bankable employment opportunities,” President Chakwera said.

The Centre for Public Accountability Acting Director Kondwani Munthali immediately responded, calling The Reserve Bank of Malawi and the Ministry of Mining to account for the gold the President talked about.

“We want to know the names of those with licences to export gold, how much has been exported and how much revenue has been collected. Let there be a parliamentary open inquiry on the externalization of minerals and foreign exchange and release of information by the Anti-Corruption Bureau and Financial Intelligence Unit on persons named or arrested in relation to foreign exchange matters,” Munthali said.

Secretary for Mining Dr Joseph Mkandawire said they have now established structured markets and that 38 individuals and seven cooperatives have been issued with licences to do gold mining.

“As of December 31st, we had made K2.6 billion from the 58.1kg which the Reserve Bank of Malawi, which is the sole buyer of gold in Malawi, collected,” Mkandawire said.

Weak laws

Exchange control violations in Malawi under the current Exchange Act attract jail terms of a maximum of two years or alternative penalty fines of between US$6 to US$31 (K5,000 to K25,000), hardly deterrent to any would-be criminal. Even though the country has a comprehensive anti-corruption legal framework, enforcement is a challenge due to poor resources.

National tax collector Malawi Revenue Authority (MRA) agrees that IFFs are “huge”, citing tax evasion, tax avoidance, trade mis-invoicing (under-declaration, over declaration), and smuggling, as some forms of IFFs common in Malawi. They were not able to quantify when asked, however.

“The scale has not been determined empirically, but it is widespread,” said MRA Manager-Marketing Communications Wilma Chalulu.

The 2021 Enact report has highlighted that Malawi’s borders continue to be porous. An observation at Dedza border revealed how forex was illegally crossing between the borders of Malawi and Mozambique. A road, without any form of barrier, separates the two countries before the actual border.

Vendors trading in forex explained that it is very easy to illegally take forex into and outside the two countries.

“Plying in forex trade is not illegal on the Mozambican side. So, when one has a customer, they just cross to the Mozambican side. Some customers who don’t want to declare their forex at the border give us their money and we easily cross the borders without problems. Actually, we have police officers and other officials who are friends, they know what we do but they can’t arrest us because we are friends,” one vendor said.

As the African continent continues to lose $50 to 148 billion every year, SADC has been stressing the need to counter IFFs for the region to meet its development goals.

United Nations has observed that the increased scale of IFFs leaving the African continent significantly undermines governments’ effort to achieve the Sustainable Development Goals by 2030.

“Tackling illicit financial flows, however, will open the door to releasing much-needed investments in education, health, and productive sectors,” said Mukhisa Kituyi Secretary-General of the United Nations Conference on Trade and Development (UNCTAD) in 2020 Tackling Illicit Financial Flows for Sustainable Development report.

Malawi 2063 vision is advancing governance systems that will promote sound financial and economic management.

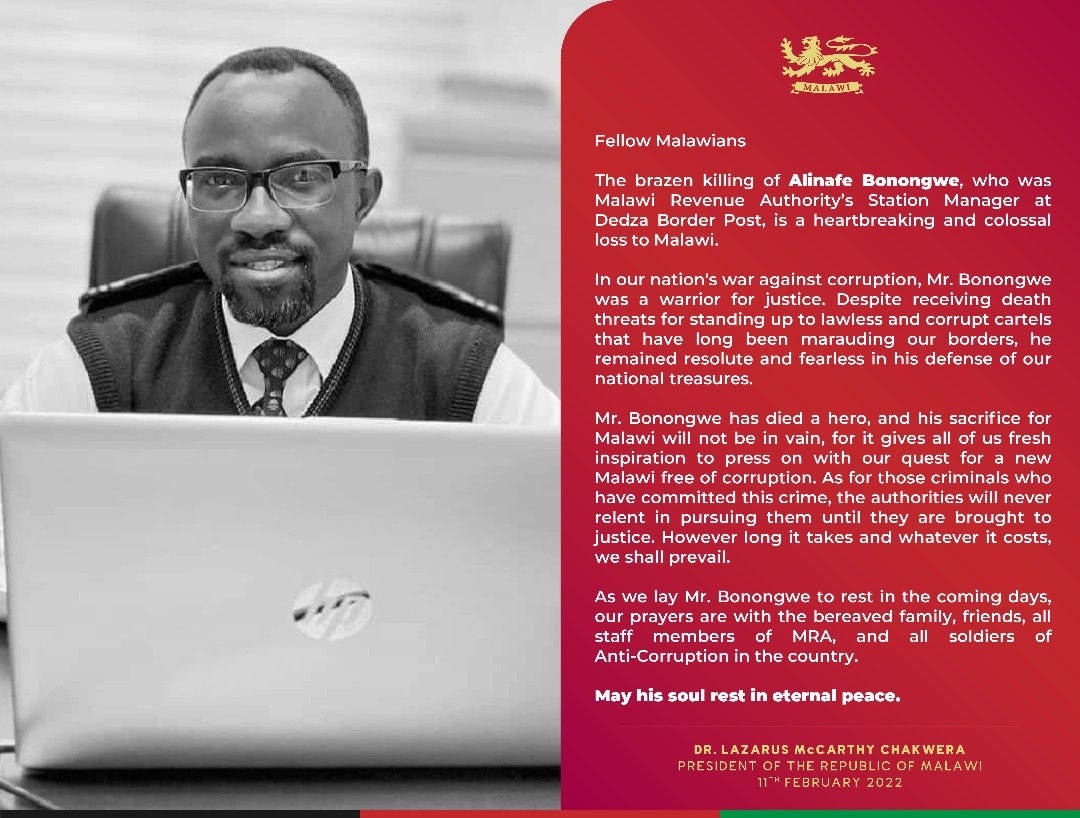

Meanwhile, police in Malawi are investigating the death of Mr. Alinafe Bonongwe, a Malawi Revenue Authority Dedza Station Manager who was found dead on 4 February 2022 at his house in Dedza district.

“He tirelessly waged war against corruption and smuggling and conveyance of goods, fraud, and bribery in line with MRA’s mission, vision, and core values,” reads a statement from MRA, in part.

Reacting to the news, President Lazarus Chakwera described the late Bonongwe as a warrior.

“Despite receiving deaths threats for standing up top lawless and corrupt cartels that have been marauding our borders, he remained resolute and fearless in his defence of our national treasures,” said the Malawi leader.

This story was produced by the AfricaBrief. It was written as part of Wealth of Nations, a media skills development programme run by the Thomson Reuters Foundation. More information at www.wealth-of-nations.org. The content is the sole responsibility of the author and the publisher.