African Debt Crisis Deepens, Civil Society Demands Reform

Data reveals Africa's public debt skyrocketed 374% from 2000 to 2024, pushing 30 million into extreme poverty in 2021 alone.

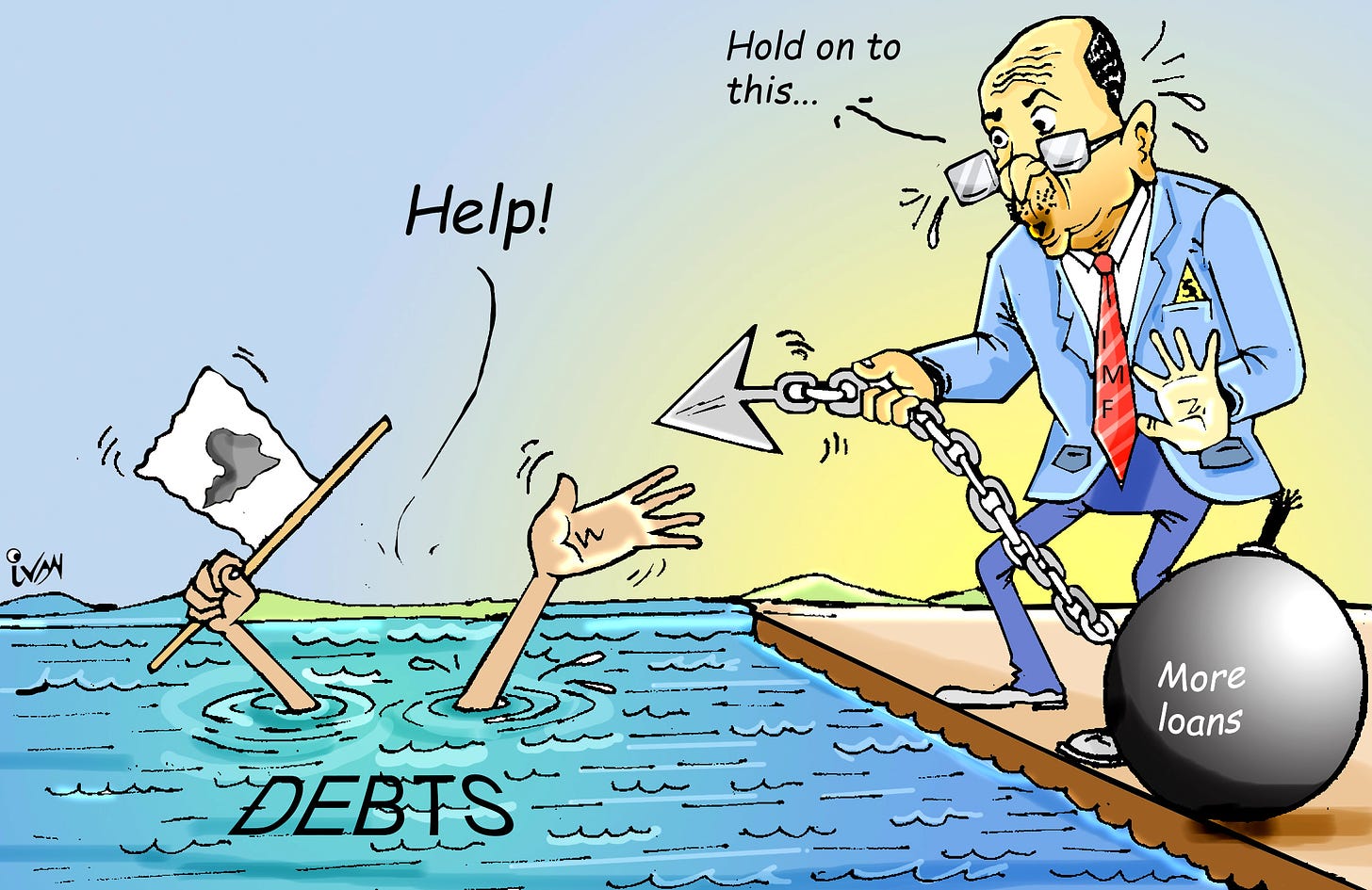

HARARE, ZIMBABWE-The African debt crisis has escalated, prompting civil society groups to urgently call for a restructuring of the global financial system during the IMF and World Bank's 2024 Spring Meetings in Washington DC from 17-19 April, writes Winston Mwale.

With nearly half of African nations in debt distress and total debt soaring to $1.13 trillion, existing debt relief initiatives have proven inadequate.

Data reveals Africa's public debt skyrocketed 374% from 2000 to 2024, pushing 30 million into extreme poverty in 2021 alone.

Debt-to-GDP ratios average 198% in Sudan, over 100% in DRC, Mozambique, and Zambia.

The African Forum and Network on Debt and Development (AFRODAD) argues debt servicing consumes substantial public resources, hampering investment and development.

"The debt crisis is no longer a risk, but a reality," says AFRODAD Executive Director Jason Braganza. Previous relief efforts like HIPC, MDRI, DSSI and the G20 Common Framework enabled more borrowing while beneficiary countries struggled developmentally compared to non-recipients.

The G20 Framework's shortcomings include lack of outright debt cancellation, excluding distressed middle-income nations, favoring bilateral over private debt, risking credit downgrades, and coordination challenges between creditors.

Countries like Chad, Ethiopia, Ghana, and Zambia applying hit roadblocks.

"Unless we urgently fix the global financial architecture, we'll see Agenda 2063 progress reversed, hitting the vulnerable like women and girls hardest," warns Braganza.

Civil society groups argue the IMF and World Bank fueled Africa's "debilitating financial commitments" through policies prioritizing creditors over people.

UN General Assembly President Dennis Francis joins "the call for a more just, equitable, development-oriented debt architecture" allowing fiscal space.

Critics highlight the Framework's implementation struggles.

While Zambia reached an official creditor deal, Ghana's restructuring stalled as the IMF deemed it unsustainable.

Experts argue debt relief must accompany structural reforms addressing the financial system's root problems.

As meetings convene on accelerating African energy access, civil society insists acknowledging the institutions' role in perpetuating debt, dependency and poverty is crucial for real reform benefiting citizens.

*Download Afrodad statement below: