African Debt Crisis Deepens, Calls for New Financial Architecture Grow

The paper reveals that Africa's public debt has skyrocketed from $233 billion in 2010 to $645 billion in 2021, with 23 low-income African countries now in debt distress or at high risk.

HARARE, Zimbabwe -- Africa's debt crisis is worsening despite years of international financial policies aimed at curbing the continent's borrowing, according to a newly-released African Forum and Network on Debt and Development (AFRODAD) policy paper, writes Winston Mwale.

The AFRODAD report highlights the urgent need for a reimagining of debt management strategies and calls for homegrown African solutions.

The paper reveals that Africa's public debt has skyrocketed from $233 billion in 2010 to $645 billion in 2021, with 23 low-income African countries now in debt distress or at high risk.

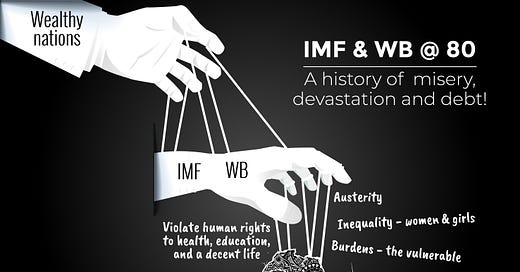

This surge comes despite the implementation of various debt management policies by international financial institutions (IFIs) like the International Monetary Fund (IMF) and World Bank.

"The outcomes from the use of the different management policies of these multilateral groups, while making a positive impact, have not stopped the re-emergence of the African debt crisis," the report states.

The situation is particularly dire in countries like Zambia and Angola, where public debt has reached approximately 120% of GDP. Ghana's debt stands at 86% of GDP, underscoring the widespread nature of the crisis.

Critics argue that current debt sustainability frameworks fail to adequately consider the human cost of austerity measures. The report notes that these policies "remain devoid of the implicit and explicit costs associated with unsustainable debt levels, such as social security cuts and medical care cuts."

The Harare Declaration, cited in the paper, confirms that "the current debt and financial architecture are currently not working for Africa and her citizens." This sentiment echoes growing calls for a new approach to debt management that prioritizes African interests and development goals.

Among the recommendations, the report suggests:

1. Revising debt sustainability frameworks to better reflect human rights obligations.

2. Accelerating domestic revenue reforms and improving international tax cooperation.

3. Establishing an African Financial Stability Mechanism to protect against global shocks.

4. Enhancing transparency in borrowing terms and debt structures.

"There is an urgent need to rethink and arrive at the best possible alternative solutions to these policies," the report emphasizes.

As African nations continue to grapple with the fallout from multiple crises, including COVID-19 and the Ukraine-Russia war, the need for innovative and Africa-centric debt management strategies becomes increasingly apparent.

The continent's ability to achieve its development goals, as outlined in the African Union Agenda 2063, may well depend on successfully navigating this complex financial landscape.

*Download the report below: